Crypto Exchange

The biggest issue with crypto exchanges is that they have limited liquidity. Unlike a traditional stock market, where the entire supply of stocks is available at any time, the crypto exchanges have very little inventory. This limits their liquidity. Also, cryptocurrency has limited liquidity, especially with tokenised assets linked to physical properties. Thus, traders often prefer an OTC market because of the flexibility it offers.

Decentralized OTC crypto exchange

There are many benefits to buying a stock outside of the centralised platform. Buying foreign stocks in the local market is easy and fast. There is less bureaucracy involved. Additionally, the trade volume is significantly higher in an OTC market. The main difference between the two is that an OTC firm can have a greater influence on digital assets than an exchange. This means that both have different advantages.

Buying and selling outside a centralised platform has many advantages. For example, there is less bureaucracy. Moreover, it is possible to buy and sell foreign stocks within the local market hours. The biggest drawback is that trading on an OTC platform is less reliable. However, it is possible to get an insight into how big players are influencing the price of a specific crypto asset.

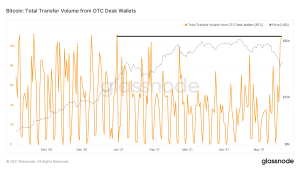

Crypto Exchange Volume Vs OTC Volume

When looking for the best trading opportunities, cryptocurrency exchanges with the highest volumes will offer the most opportunities. Increasing trading volumes on a cryptocurrency exchange may indicate that a coin is about to take off in value, so an increase in volume is a good indicator of a large price move. However, some people have accused some of the crypto exchanges of fabricating trading volume figures. One trader, Sylvain Ribes, found enormous slippage when he sold $50,000 worth of cryptos. He revised his trading amount to only $20, which indicated that 93% of OKEx’s total volume was fake.

A good way to compare the volume of a crypto exchange and its OTC counterpart is to compare them. Generally speaking, a high volume indicates a strong market. A low volume is indicative of a weak market. Using the order book as a guide is important when it comes to analyzing a cryptocurrency. It is a good indicator of the price trend, even if it is a short-term one.

The difference in volume is not only visible on the exchanges, but in the OTCs as well. Obviously, the latter has a lower trading volume than the former. This means that the exchanges have a greater influence on their market than the OTCs. This is why they are better able to offer competitive prices. But the difference between exchanges and OTCs can be quite significant in terms of their overall trading volumes.